Don't just dream about your dream car.

Find it now.

1. Fix your credit score

After receiving your application for auto insurance, companies perform hard inquiries on your credit report. This information helps your car insurance provider to assess your payment history. An excellent credit score is a sign that you pay all your monthly debt obligations on time and in full.

Car owners with poor credit scores find it hard to qualify for Cheap Car Insurance quotes due to one reason. Car insurance companies find it hard to trust them because of unsatisfactory payment histories. A poor credit score is an indicator that the car owner is highly likely to fall back on their monthly insurance payments.

Read about the 8 Credit Habits to Start in 2018

2. Compare insurance premiums to the value of your car

Some insurance companies usually sell collision and comprehensive packages to drivers who own motor vehicles aged from 8-10 years. Old cars are more likely to suffer significant damage due to advanced wear and tear. Since auto insurance companies are keen on profit maximization, they differentiate liabilities into two types.

The comprehensive auto insurance plan offers compensation whenever your car suffers damage due to bad weather, falling objects, theft, and vandalism. Collision, as the name suggests, provides compensation whenever your car hits or gets hit by another car.

Now that you know the difference between these two covers, you should determine whether they reflect the true value of your car. In order to do this, add up what you pay per month in the collision and comprehensive premiums. Multiply the sum by 10 and compare it to your car’s market value. If the sum exceeds your car’s value by 50 %, find a more affordable auto insurance provider.

3. Request for low-mileage offers

Long-distance drivers have a higher rate of car accidents than car owners who drive less than 500 miles per month. If you do a little research, you’ll notice that fatigue and poor visibility due to driving at night cause thousands of car accidents annually.

Car insurance companies reward responsible drivers by offering Cheap Car Insurance covers such as pay-per-mile. You pay a fixed fee every month that’s hugely discounted compared to typical collision, comprehensive or third-party car insurance premiums. You also pay a very low rate for each mile covered per month. MetroMile offers pay-per-mile car insurance that costs 3.2 cents per mile.

4. Visit several car insurance companies

Smart clients always assess every offer in the market before making a purchase decision. Visiting all the car insurance providers in your city will help you to ask important questions to the right people. Sometimes making inquiries through phone calls can be frustrating whenever the insurance customer care representative keeps on referring you to different people along the chain of command.

Don’t allow the car insurance companies you visit to perform hard inquiries on your credit report. Each inquiry deducts five points from your current credit rating.

5. Fit your car with safety accessories

Vandalism and car break-ins fall under the comprehensive car insurance package. Car insurance companies determine this premium by assessing your motor vehicle’s safety level. If a car is too vulnerable, one cannot secure a good comprehensive cover because they pose a great risk.

Ensure that you’ve installed a renowned alarm system in your car. This is your first line of defense against theft. You also need reverse parking sensors to prevent any collisions when parking in packed lots. It’s also important to enhance your car’s visibility by placing strips of reflective tapes on your front and rear bumpers.

You can qualify for Cheap Car Insurance quotes by properly preparing for accidents. For instance, owning a fire extinguisher shows that you’re adequately prepared to handle minor fires. A life hammer will help you smash surrounding windows in order to break free from mangled wrecks.

Make sure you purchase high-quality car safety accessories because insurance companies will always inspect their quality when you file for collision or comprehensive compensations.

6. Do not add terrible drivers to your insurance policy

Have you ever heard about an auto insurance score? It’s a three-digit number used to predict a car owner’s probability of filing for compensations. Since car insurance companies receive compensation claims whenever accidents occur, it’s safe to say that an auto insurance score indicates the probability of a driver getting involved in an accident.

The auto insurance score bears some similarity to financial credit scores. If your auto insurance score is less than 524, you have a high probability of filing compensations. A borrower with poor credit often pays high-interest rates on credit. Similarly, car owners with poor auto insurance scores end up paying expensive insurance quotes.

7. Consider installing a car blackbox

A car blackbox or an Electronic Data Recorder (EDR) is a device installed in a motor vehicle in order to help insurance companies monitor a client’s driving habits. It works in a similar manner as an aircraft’s blackbox. Each day, your car insurance provider receives accurate information on miles covered, hours spent on the road, and your average speed.

Installing a car blackbox can help you get a good driver discount because it provides your car insurance with credible and real-time information on your driving habits. You can also approach your car insurance company and request for a pay-per-mile cover. If your insurance provider is happy after reviewing data transmitted by your car black box, you don’t need to do any extra persuasion.

8. Attend a defensive driving course

Car insurance companies reward you with discounts for every measure taken to enhance responsible driving and road safety. Nowadays, you can get Cheap Car Insurance quotes by simply enrolling for a defensive driving course. It’s highly affordable and takes less than a couple of weeks but you’ll enjoy the benefits for an entire lifetime.

So, what is defensive driving? It’s the knowledge and set of skills drivers use to anticipate and avoid collisions. Defensive driving teaches you how to avoid colliding into drunk drivers. You also learn how to control your car when driving in rainy or snowy weather.

9. Park your car in a secured place

One common reason why some car owners don’t receive compensation for auto theft is negligence. A car is a valuable item and your auto insurance expects you to be watchful at all times. Perhaps the main reason why your car insurance quotes are expensive is that you park your car overnight in a street or outside a convenience store instead of an enclosed garage.

Streets and open public parking spots attract burglars who have insatiable appetites for car music systems, rims, and tires. That’s why insurance companies charge expensive insurance quotes to encourage you to park your motor vehicle in well-guarded homes or parking lots.

10. Relocate to a safer neighborhood

If you live in a neighborhood that has a reputation for high car burglaries, your insurance company will charge you costly car insurance quotes. High crime rates increase your probability of filing for compensations. If the crime rate happens to increase, your provider will also increase your quotes promptly.

Consider saving up and relocating to a better neighborhood. Car owners who live in gated communities enjoy Cheap Car Insurance quotes due to the availability of adequate security features. For instance, the presence of armed security guards, high perimeter walls, electric fences, and home garages

Search Used Exotic Cars

Looking for something else? Contact Us

Search Car Reviews

It's rare that you get to test drive every car you're interested in. This is where car reviews can come in handy. We've specially formulated our car review search tool to find you the best and most reliable car reviews on the web.

Read and Compare Top Car ReviewsGet New Car Quotes

Want to get an idea of what a new car might cost you? Our new car quotes tool will provide you with multiple competing quotes from dealerships near you.

Get Competing New Car QuotesYour Searches is disabled

Enable Your Searches to save your favorite searches for quick searching later.

As featured in:

Popular Searches

Unsure where to start? These are some of the most sought-after models on AutoZog!

Love Exotic Cars?

So do we. Follow our Instagram page.

View this post on Instagram#bentlydubai #bently #atlantisdubai

A post shared by AutoZog (@autozog) on

View this post on Instagram#rollsroycephantom #rollsroycedubai #dropheadcoupe

A post shared by AutoZog (@autozog) on

AutoZog Tools

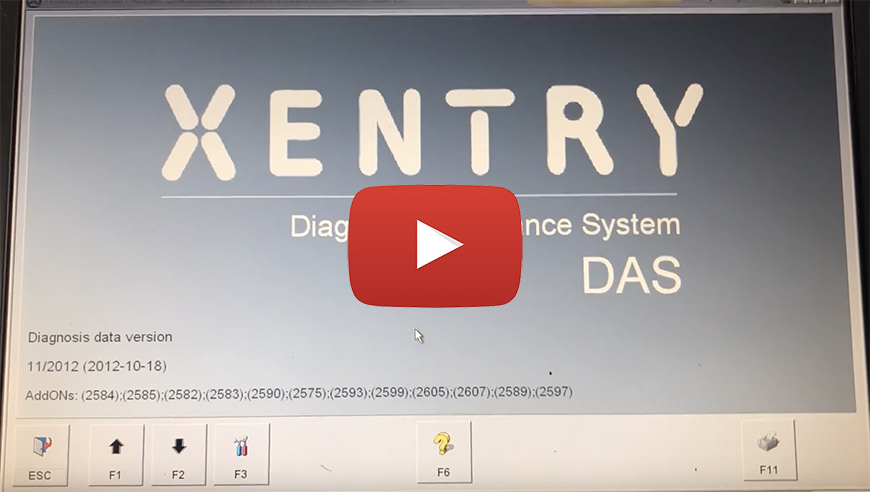

Popular How to Videos.

Research what model is best for you.

Figure out what models you're interested in and use our research tools to narrow the field to the model that's perfect for your lifestyle and budget.

- Review Search

Review Search

It's rare that you get to test drive every car you're interested in. This is where car reviews can come in handy. Our car review search connects you with the best and most reliable car reviews on the web. Think of it as your virtual showroom.

Read and Compare Top Car Reviews- Used Car Search

- New Car Quotes

Used Car Search

The AutoZog used car search brings together the most used car listings from all the top sources on the web, totaling over 5 million listings.

Find Your Perfect Used CarNew Car Quotes

Considering buying new? Our new car quotes tool will provide you with multiple competing quotes from dealerships near you.

Get Competing New Car QuotesFind your perfect used car.

Finding your next car for the best price means comparing what's out there. Use our search and compare tools to find all the used cars for sale in your area and get quotes on new ones.

Buy your next car.

Time to buy insurance? Need to ship your new car across the country? Our buying tools help simplify those decisions.

- Insurance Quotes

- Shipping Quotes

Insurance Quotes

If you're not comparing car insurance quotes, you could be giving away hundreds of dollars a year. Find out how much you could be saving.

Compare Insurance QuotesShipping Quotes

AmeriFreight

AmeriFreight is a shipping company you can trust. They offer discounts to members of the military, police, and emergency services, as well as to seniors and students. Get a quote from Amerifreight here.

uShip.com

This site is very helpful, they are the eBay of shipping. You post what you want to ship, and you'll get quotes from carriers with empty space. Since they're selling their extra space, you can often find great deals. Get an estimate

AutoZog Guides

Never bought an Exotic car before?

When you have the right skills and information, the Exotic car buying process is easy and enjoyable. Here are some of the guides we've put together to help you on your way to buying your perfect car.